ANXIETY ABOUT FAIR VALUE OF STOCKS!

When you are into trading, the anxiety of buying at right price is normal. It is for this reason, while Trading in Equity is important to understand these 2 analyses

1. FUNDAMENTAL ANALYSIS

2. TECHNICAL ANALYSIS

In this blog we will focus on Fundamental Analysis.

Fundamental analysis assesses a company’s potential based on financial and non-financial data to obtain the intrinsic value, to understand growth & financial status of the company apart from how they impact the market & the users

1.Types of Analysis

The critical aspect of performing fundamental analysis are

1. Studying :

a. Economy

b. Industry

c. Company

To understand the economic value & the position in the market

2. Understanding of financial performance:

Understanding balance sheets, income statement, cash flow, price to book value of equity, the net market value of assets

3. Understanding Non-Financial Aspect:

Business policies, Management efficiency, impact on media & analysts and its ability to keep the market sentiment better which includes brand-value

4. Analysis:

Use of Financial Ratios to determine a company’s financial standing. It is used along with the available financial data from past reports to measure future growth & stability

5. Methods of Valuation:

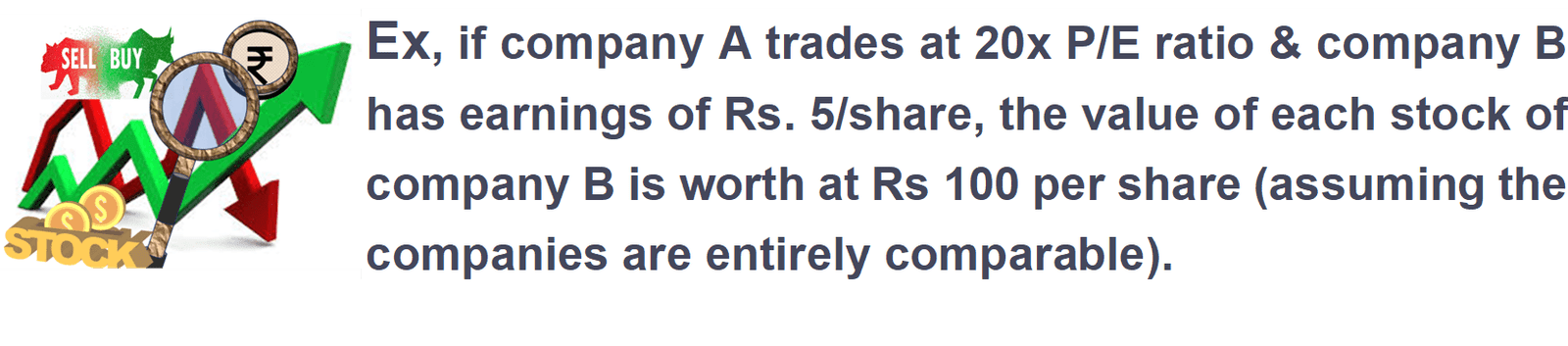

A. Comparative Analysis:

• provides an observable value for the business based on what other companies are worth by studying trading multiples such as P/E, EV/EBITDA, or other ratios.

B. Precedent Transactions

In this method recently sold/acquired businesses in the same sector are taken as a benchmark to arrive at the value of the company’s stock.

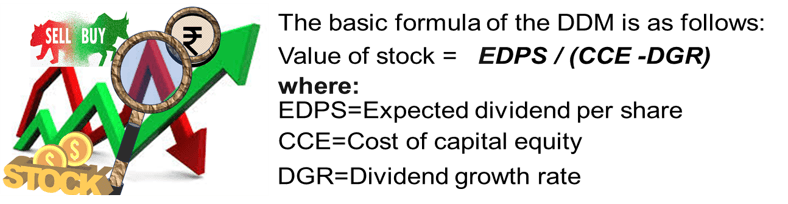

C. Dividend Discount Models

For arriving at stock’s intrinsic value, CASH is KEY.

Various models calculate fundamental value of a security factor in variables & utilize the time value of money (TVM).

One such popular model to arrive company’s intrinsic value is the dividend discount model (DDM).

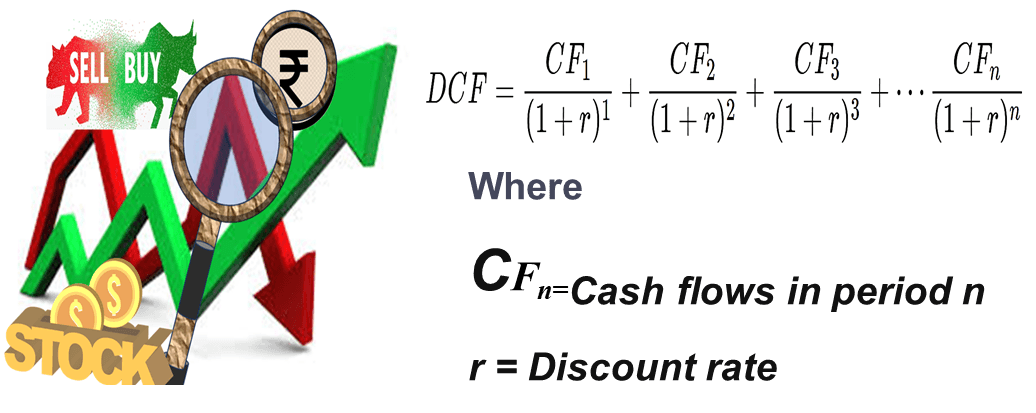

DCF Analysis – most popular

Using future cash flow of the business and discounting it to present value by using the firm’s Weighted Average Cost of Capital (WACC).

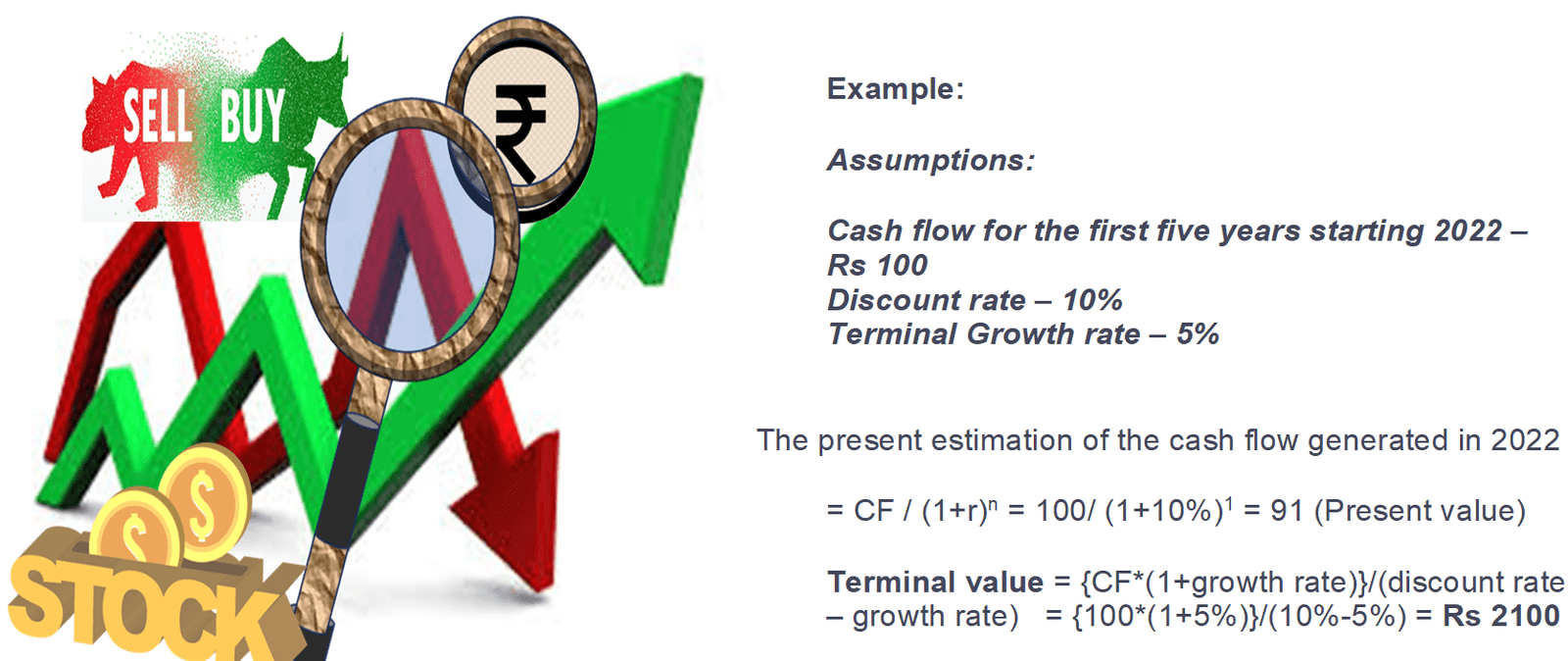

Example for understanding

Though all these models are subjected to risk & volatility in the market apart from irrational investors behaviour it can provide a clearer indication of a company’s financial health.

Recommend0 recommendationsPublished in Entrepreneurship and Finance

Responses