INCOME TAX FOR SALRIED – PART 1

Every March, lots of marketing TAX-SAVING investment product & salaried are struggling to reduce tax-payments. This urgency is clear because of reasons like

- New salaried class is having different constraints compared to older generations, where fixed asset was considered as support for better living standard, which is not so now!

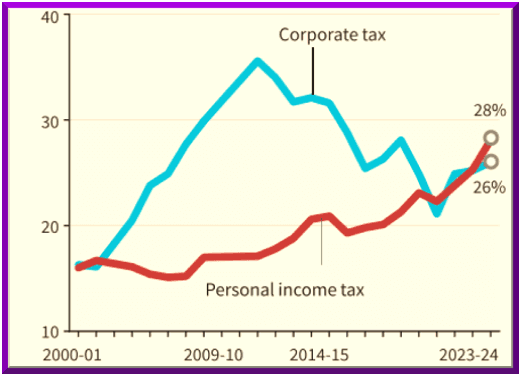

- Streamlining of personal taxation through simplification of deductions & concessions by govt is effectively stopping the leakages. These initiatives have led to the situation where in the direct tax collection to GDP (6% highest in last 15year) high during last year compared to corporate taxes (3% of GDP).

- As per Govt information (% of as of Feb end every year) In 2023, t personal tax contribution increased from 50.06% to 53.3% compared to previous year. During 2023, personal tax has increased by 17.7% to 19.58 lakh crores.

My friend phoned up recently saying that his daughter has to pay more than 1.5 lakhs on IT & wanted ideas to save tax.

So, I thought of presenting these observations for the benefit of taxpayers to elucidate a clearer picture about personal taxation & how to optimize tax outflow. We will be discussing about

New Tax Regime Vs Old Tax Regime

Default regime & its implication

Tax Slabs & how to Choose the taxation regime

Recommend0 recommendationsPublished in Entrepreneurship and Finance, Lifestyle

Responses